Some of our smaller clients can feel that an audit is a little excessive for their needs, but that they have no option but to have one. When we suggest having a review instead, we often get asked about the difference between an audit and a review. Here’s a quick explanation.

There is definitely value in doing a full audit, as it is not just about compliance. However for certain smaller entities, a review can reduce the cost and time involved in an audit and provide the appropriate level of assurance.

So what is the difference?

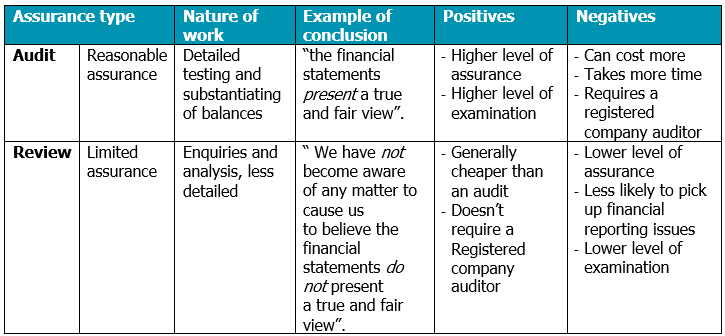

A review provides limited assurance rather than a reasonable amount of assurance, so in simple terms, a review reports on the plausibility of the financial statements.

An audit is the examination of the financial reports for an entity in order to determine whether the information presented reflects the financial position of the entity at a given date. An audit aims to identify material misstatements in the financial statements and includes, but is not limited to, misstatements resulting from fraud where reasonable suspicion exists. An audit provides a reasonable level of assurance in the form of a positive statement such as ‘presents fairly’ or ‘presents a true and fair view’. An audit does not give absolute assurance (as this would require testing every transaction which is impractical) but is the highest level of assurance provided by auditors. It involves detailed testing such as substantiating balances and evidence gathering.

A review on the other hand provides only limited assurance. The opinion given would be in a form such as ‘we have not become aware of any matter’ that the statements are not in accordance with the required framework. A review involves less detail than an audit and involves more enquiry of management/staff and analytical review work rather than substantiating balances. A review does not need to be carried out by a registered company auditor but their greater experience in this area typically means better value is delivered from the review.

Who is required to have an audit or a review?

Under the Charities and Not-for-profit Commission Act 2012 and the Corporations Act 2001, companies limited by guarantee with revenue between $250k and $1m can opt for a review rather than an audit. Those that have under $250k in revenue are not legally required to have a review or an audit.

Associations

Associations in Australia are bound by individual state laws so it is important to know which legislation an Association is reporting under. In Victoria under the Associations incorporation Reform Act 2012, associations follow the same tiers as that for the companies limited by guarantee, therefore if a Victorian association has under $1m in revenue they can opt for a review. In NSW, associations that have over $250k or more than $500k in current assets are required to have an audit completed.

It should also be noted that many constitutions have clauses that determine if an audit is to be conducted so this should also be reviewed before opting for a review.

Before deciding on a review, it is important to discuss what your organisation want to get out of the exercise. Is it pure compliance with legislation or are you looking for further oversight and assurance on the financial statements? Our audit divisions are experienced in both audits and reviews, so if you would like to discuss your options please give us a call.

By Hazel Masters, Accru Melbourne.

"

"