If your business operations rely on using highly valued plant and equipment, such as heavy machinery or a fleet of vehicles, then an equipment holding entity may be worth considering. This article will outline the operations and benefits of such an arrangement.

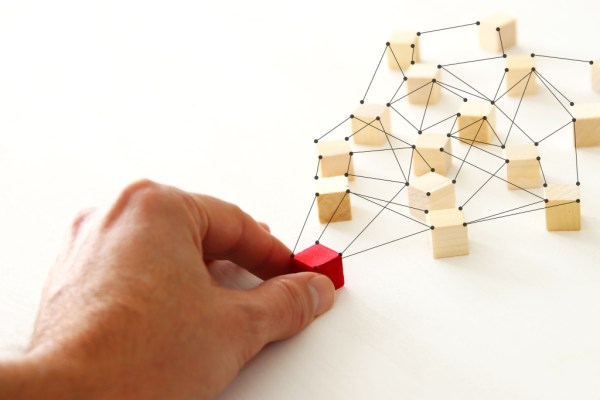

An equipment holding entity involves the relevant plant and equipment being acquired in the equipment entity, then leased to the trading entity. This isolates the equipment in a separate entity and reduces its exposure to creditors of the trading entity.

From a cash flow perspective, the trading entity then makes lease payments (typically on a monthly basis) to the equipment entity instead of financing the entire equipment purchase with its own capital or using a financier. In turn, the equipment entity finances the purchase one way or another and receives the lease income. GST applies to the lease transaction. However, there is no net GST lost as a result, as GST is claimable by the trading entity and payable by the equipment entity. From an overall cash flow perspective of the group, the bank balances may be slightly different in each entity – with one being higher, and the other lower by the same amount. However, depending on the types of entities involved, this may or may not need further consideration or have significant consequences.

Regarding the monthly lease amount, our recommendation is to ensure this is comparable to market rates for leasing of equipment to an unrelated third party. Furthermore, there should be a lease agreement in place containing the standard particulars, including who is responsible for the ongoing maintenance of the equipment, insurance, and how often the monthly lease amount is reviewed. These habits will ensure compliance with respect to the arrangement. We also recommend exploring if the lease should be registered on the Personal Property Securities Register.

Structuring of the equipment entity should be carefully considered. Most commonly a company structure would be used. Yet this does not mean that another structure cannot be used. In a very limited set of circumstances, self-managed superannuation could be used as the equipment entity.

If you currently have your equipment owned in the trading entity, there could be the possibility of transferring it to an equipment entity. However, you will need to consider any costs associated with the transfer. These costs may include income tax, transfer duty (if applicable), and refinancing of any associated debt attached to the equipment. If both entities are companies, generally there would be no tax implications for transferring the equipment via a loan, rather than in cash.

To date, the Federal Government concessional depreciation incentivises have provided most businesses with the ability to claim the majority, or all, of the cost of depreciable assets, as tax deductions. So it makes sense to have these assets in the trading entity to achieve the tax benefit. However, with the temporarily full expensing regime due to end on 30 June 2023, it may be worth considering acquiring relevant equipment after that date in an equipment entity.

The costs in relation to maintaining such an arrangement would reasonably be outweighed by the benefits. Generally, the additional costs would only be the administration costs of the entity. Whereas the benefit may mean being able to continue a business in the event of a claim from creditors.

With the current economic climate giving rise to uncertainty, and to reduce business risk in general, it is a good time to protect the key fixed assets of your business and consider an arrangement of this type. Contact your local Accru office to discuss your situation, or to ask for further insights.