We are pleased to present the May 2024 edition of our Financial Reporting Update, in this edition we will remind you about the new standards effective for the first time on 30 June 2024, discuss the new consolidated entity disclosure for public companies, provide an update on sustainability disclosures in the financial statements and highlight some contemporary issues and resources available to you.

New standards reminders

As discussed in our November newsletters, there are no significant changes to accounting standards for 30 June 2024 reporters, however the changes to the accounting policy requirements are an opportunity for entities to streamline their financial statements, remove the clutter and provide more meaningful information to their users.

The new standards with a brief description of the changes are included below:

| New accounting standard | Changes | Likely level of impact |

| AASB 2021-2 Amendments to Australian Accounting Standards – Disclosure of Accounting Policies and Definition of Accounting Estimates (Changes to Tier 2 included in AASB 2021-6) | – Introduces a definition of accounting estimates – Change from significant accounting policies to material accounting policy information + Accounting policy information is material if, when considered with other information in the financial statements, it could reasonably be expected to influence decisions of primary users based on the financial statements. – AASB 101 includes five criteria to assist with the materiality assessment:Does the policy relate to a change in accounting policy? + Does the policy document the entity’s choice of accounting treatment from the standards? + Does the policy relate to a disclosed significant estimate and judgement? + Was the policy developed by the entity in the absence of explicit guidance in the accounting standards? + Is the transaction so complex that the accounting policy is required for the user to understand the accounting treatment? | Application of this standard will lead to a significant reduction in accounting policies and provide information about how the entity is applying the accounting standards rather than ‘what do the accounting standards say’. |

| AASB 2021-5 Amendments to Australian Accounting Standards – Deferred Tax related to Assets | Clarifies that the exemption from recognising deferred tax does not apply to transactions for which entities recognise both an asset and a liability and that give rise to equal taxable and deductible temporary differences. | Entities should ensure that they have considered the deferred tax implications for transactions such as leases and makegood / rehabilitation provisions. |

| AASB 2023-2 Amendments to Australian Accounting Standards – International Tax Reform – Pillar Two Model Tax Rules Tier 2 standard is AASB 2023-4 | The standard provides: – a mandatory temporary exception to accounting for deferred taxes arising from the implementation of the Pillar Two model rules published by the Organisation for Economic Co-operation and Development (OECD); and – targeted disclosure requirements to help financial statement users better understand an entity’s exposure to income taxes arising from the reform, particularly in periods before legislation implementing the rules is in effect. | Relevant only for entities affected by the implementation of the Pillar Two Model rules published by the Organisation for Economic Co-operation and Development |

| AASB 2022-7 Editorial Corrections to Australian Accounting Standards and Repeal of Superseded and Redundant Standards | Administrative changes to accounting standards. | No impact for any entity. |

New consolidated entity disclosures for public companies

For the 30 June 2024 annual reports, public companies in Australia will be required to include a new consolidated entity disclosure statement in their annual financial reports, as mandated by the Corporations Act 2001.

This requirement affects all public companies, irrespective of whether they issue consolidated financial statements, and encompasses both listed and unlisted companies. NFP companies limited by guarantee who are registered with the ACNC will not be required to include this disclosure.

This new disclosure is part of a global effort to enhance tax transparency by making public the tax jurisdictions of each group member. This transparency is intended to provide a clearer understanding of the tax obligations across different jurisdictions and increase scrutiny of multinational corporations’ tax strategies, although it does not extend to disclosing specific tax amounts paid per jurisdiction.

Key points relating to the disclosure:

Required Details: For each controlled entity, the disclosure should include:

- its name,

- structural form (such as company, partnership, or trust),

- country of incorporation,

- ownership percentage held by the group, and

- tax residency, whether Australian or Foreign and if foreign, then the country of tax residency.

Unlike typical notes in financial statements, this disclosure will require information on all entities, including dormant or immaterial ones due to the changes to the director’s declaration.

The directors’ declaration will need to affirm that the consolidated entity disclosure information is “true and correct,” which is a more assertive requirement compared to the “true and fair” declaration for the financial statement which necessitates a higher level of director confidence in the accuracy of the disclosed information.

Standalone entity: where a public company prepares standalone financial statements, i.e. no controlled entities then the Corporations Act changes require that fact to be stated.

Audit Implications: since the disclosures will be included in the financial statements, they will be subject to audit.

Sustainability update

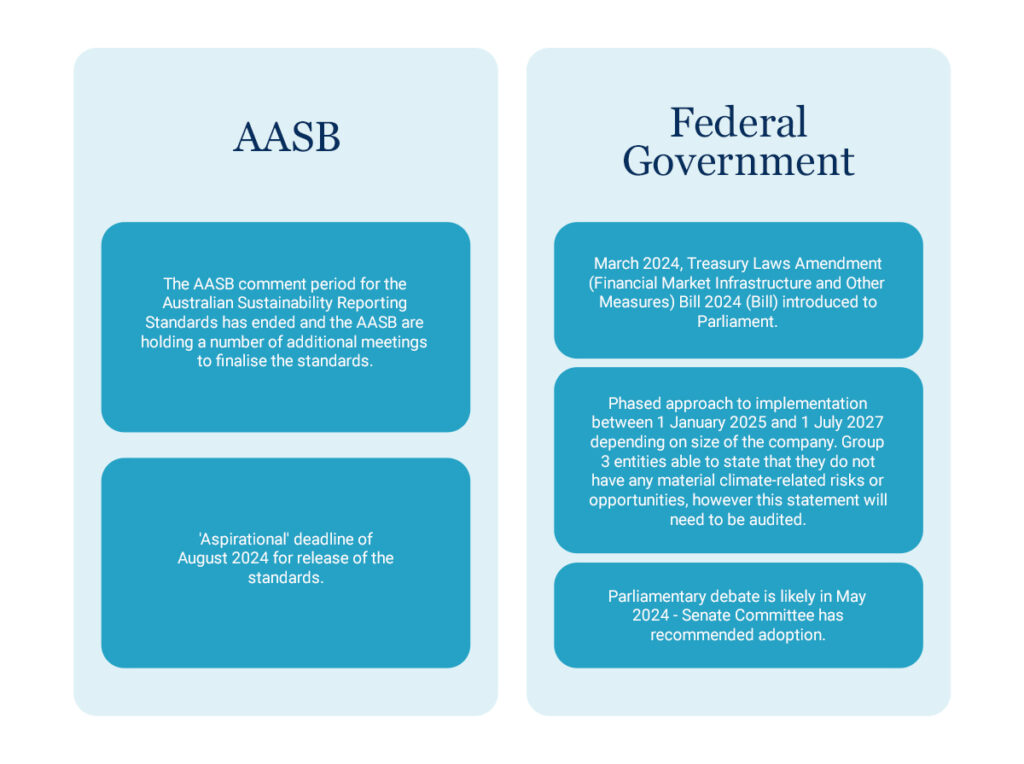

The November 2023 newsletter provided detail regarding the key players for climate-related reporting in financial statements in Australia.

As at the date of writing, the following updates have occurred.

Entities are encouraged to monitor the progress of the legislation to determine the direct or indirect impact on them or their customers / suppliers. Note that the current proposals require entities to report Scope 3 emissions, which will require information from entities in their value chain.

Contemporary issues

Going concern

Given the current economic volatility and uncertainties, it is anticipated that there will be an increase in the number of going concern disclosures within financial statements at 30 June 2024.

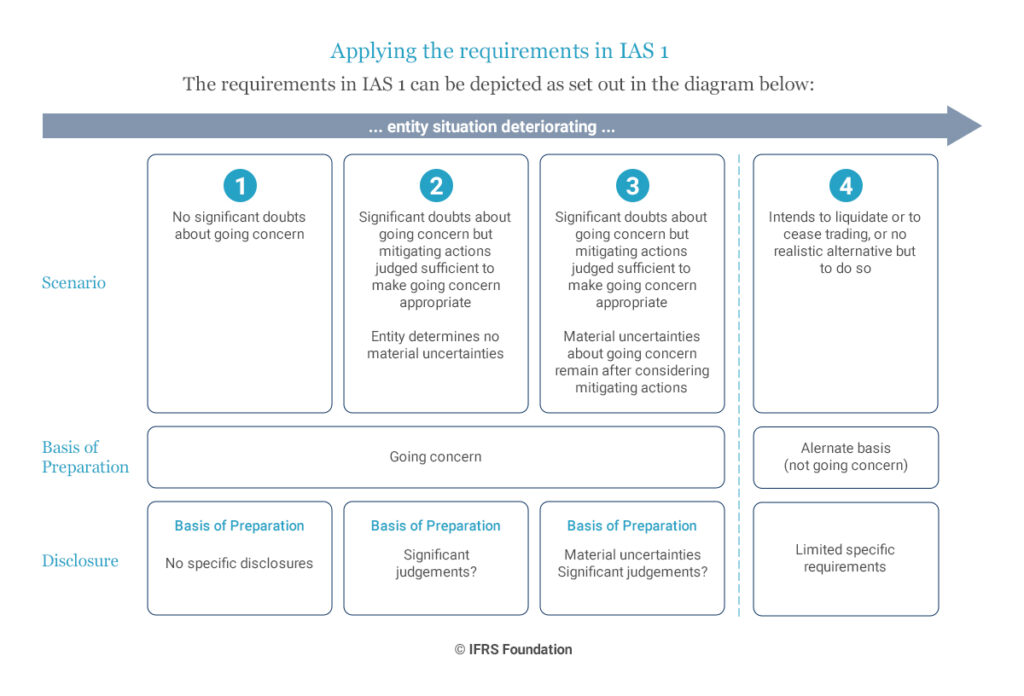

In accordance with AASB 101 Presentation of Financial Statements, entities must carefully assess their ability to continue as a going concern and disclose related uncertainties when there is significant doubt about their capacity to operate in the foreseeable future.

While guidance on this topic in the accounting standards can be sparse, the International Accounting Standards Board (IASB) published educational material in 2021 that offers valuable insights into making these assessments and disclosures.

Entities are encouraged to consider this educational material to better understand the requirements of AASB 101, the table below can be a useful discussion starter with Boards / Audit and Risk Committee and Auditors.

We encourage entities who may be required to disclosure information about going concern to reach out to their Accru advisors as soon as possible.

Revenue disclosures – disaggregation

We have had an increased number of discussions with our clients regarding revenue disclosures, in particular around disaggregation.

Both AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities, require entities to disaggregate revenue into categories that depict how the:

- nature,

- amount,

- timing, and

- uncertainty of revenue and cash flows

are affected by economic factors.

This disclosure is designed to give users of financial statements a more detailed understanding of the sources of revenue and the risks associated with them as well as how each stream contributes to the overall business performance.

The standards don’t mandate the extent of disaggregation, however, provide a number of examples of disaggregation for an entity to determine which is most relevant for them, including:

- By Type of Goods or Services: A technology company might report revenue from hardware sales, software licenses, and maintenance services separately.

- By Geographic Region: A corporation may disaggregate revenue by region (e.g., Americas, Europe, Asia-Pacific) to show where its income is being generated which helps in understanding the exposure to geopolitical risks and economic conditions in different parts of the world.

- By Type of Customer: A business might segment revenue by customer type, such as retail customers, wholesale customers, or government contracts which illustrates dependencies on particular customer segments.

- By Contract Duration: Companies with long-term contracts might disaggregate revenue based on the duration of these contracts (short-term vs long-term), highlighting how revenue recognition is impacted over different periods.

- By Sales Channels: Disaggregation can also be done based on different sales channels, such as online sales, direct sales, or third-party distributors. This helps in assessing the effectiveness and profitability of each channel.

Not-for-profit entities may consider, disaggregation by:

- Funding Source: NFP may have a number of funding sources, including government grants, fundraising activities and donations:

- By Activity or Program: depending on the activities of the NFP, it may be useful to the users to understand revenue from service delivery, including specific services provided to the community, like educational programs, health services, or support programs compared to revenue from membership fees etc.

Resources to assist with disclosures

Our audit teams are often asked for examples of disclosures for certain transactions, events and conditions and the UK Financial Reporting Council (FRC) thematic reviews can be a useful resource for a number of topics.

These review focus on disclosure areas where the FRC believe there is scope for improvements, and they highlight good and bad disclosure examples as well as providing some tips to comply with the accounting standards.

While the reviews primarily focus on listed companies in the UK, the principles and best practices outlined are broadly applicable to Australian entities as well, given that both regions base their standards on IFRS. Australian entities are encouraged to consult these reviews to inform their disclosure practices and best practices.

If you want any more information on any of the topics discussed in this article or to discuss the application to your specific circumstances, please get in touch with your local Accru representative.

"

"