There are many myths surrounding the contractor vs employee rule. Here we bust a few of them and provide a brief summary of the rules. It’s more important than ever to get it right.

It used to be that the Australian Taxation Office (ATO) encouraged workers to be contractors, and that by getting an ABN you would satisfy the guidelines. However in recent years the ATO’s approach has changed.

It is now harder to prove a contractor relationship and it’s not as simple as having an ABN. There are many reasons for the tighter rules, including superannuation, insurance and PAYG withholding obligations for employers.

Myths BUSTED

Myth 1: I have an ABN which means I am a contractor

Busted: Having an ABN does not automatically classify a worker as a contractor. The nature of employment must be looked at to determine the classification.

Myth 2: Everyone in my industry is a contractor, it’s the nature of my business

Busted: Just because everyone else is doing it, doesn’t make it right. Ignore ‘normal’ industry practices when deciding if a worker is a contractor or employee.

Myth 3: A worker has asked to be paid as a contractor

Busted: Workers often prefer to be paid as contractors as this usually means a higher pay for them as this amount would include super, tax and leave entitlements. However no matter how much they want to be classified as a contractor, the ATO will look at the facts and make a judgement on this basis.

Myth 4: A written contract is in place which specifies a worker is a contractor

Busted: If the ATO deem a worker to be an employee, a contract which states the worker to be a contractor makes no difference.

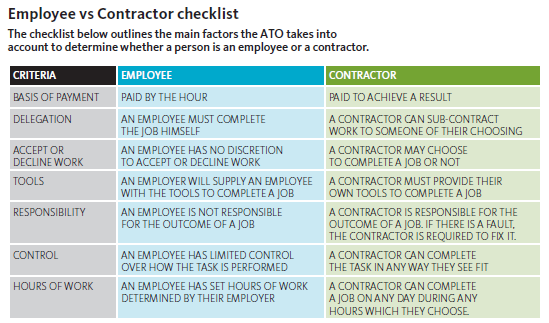

The above factors will generally determine whether you have an employee or contractor, and the ATO website provides a calculator for this purpose. It’s also wise to undertake an ABN (or company) search of a person or company before engaging them as an independent contractor.

This issue can be a grey area so if you have any questions, your local Accru office will be more than happy to help. We can also provide advice on FBT & Salary Packaging to maximise benefits and attract staff.

"

"