For businesses commencing export activities or already pursuing overseas markets, Austrade’s Export Market Development Grant may be a valuable source of assistance. Read on to find out if your business is eligible and what expenses can be claimed.

The Export Market Development Grants (EMDG) scheme, administered by Austrade, aims to encourage small and mid-sized Australian businesses to develop overseas markets. It is a government financial assistance program which provides reimbursement for the first two years of up to 50% of eligible export promotion expenses incurred, applicable to the portion of expenses above $5,000. From the third year of receiving grants onwards, the business must satisfy certain other requirements for which Accru can help assess you. The scheme can provide up to eight grants to each eligible applicant. The maximum grant is $150,000.

Eligible businesses

Nearly all forms of Australian business structures engaged in export promotional activities are eligible for the EMDG, including sole traders, partnerships, companies, associations, co-operatives and trusts.

A business must satisfy the following criteria:

- The business’s income cannot be more than $50 million in the grant year;

- The business must have incurred at least $15,000 on eligible export promotion expenses in the grant year (new applicants can combine two years); and

- The products being promoted for export must be owned by the business and sold or intended to be sold directly to overseas buyers.

Applicants who do not fit the above criteria may nonetheless apply, including manufacturers, approved bodies and joint ventures, tourism service suppliers, event promoters, or other business structures deemed appropriate for the scheme such as wholly owned subsidiaries.

Eligible products

To be eligible for the EMDG, the business must promote one of the following overseas:

- Export of goods made in Australia, or goods made offshore if the goods sale overseas will generate a significant net benefit to Australia

- Export of most services other than those specified as ineligible in the EMDG regulations

- Supply of tourism services to non-Australian residents including accommodation, passenger transport or tours

- Intellectual property rights or know-how, predominantly resulting from work performed in Australia

- A trademark that was owned, assigned or first used in Australia

- A conference or event held in Australia.

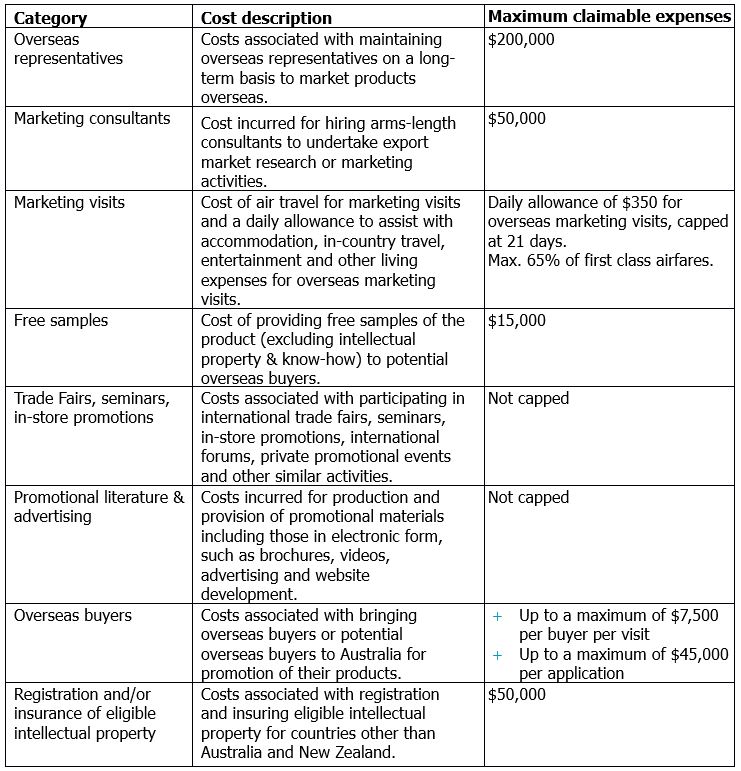

Eligible expenses

Eight categories of expenses can be claimed by businesses that meet the above criteria and are outlined below. Expenses must be incurred while your business is a resident of Australia. The grant excludes expenses for which a third party pays, commissions, discounts, pre-payments for goods, tax, cash payments of over $10,000, non-promotional activities, after-sales activities, activities that have a detrimental impact on Australia’s trade reputation and expenses related to promoting trade with New Zealand and North Korea, and Iran up to and including 17th January 2016.

Despite the maximum claimable expenses below, you should include all eligible expenses that you wish to claim in your application to maximise the grant. Accru’s Sydney office specialises in helping Australian businesses expand overseas. Please consult your Accru advisor for further advice.